As reported in the Philadelphia Inquirer

Drawn by booming industry, driven from the South by repression, African Americans’ population in Philadelphia swelled at the beginning of the 20th century. As they arrived, Philadelphia adapted by baking segregation into property documents.

By 1930, the black population of Philadelphia had reached 219,000, according to the Pew Center for Art and Heritage’s Great Migration Project, triple what it was 20 years earlier. A new study from the Federal Reserve Bank of Philadelphia has found that between 1920 and 1932, the deeds for thousands of Philadelphia homes included racially restrictive covenants, language barring minorities from buying into a neighborhood or even living in it.

“I think very few people realize this kind of thing was happening, especially in the city of Philadelphia,” said Larry Santucci, a senior research fellow at the Consumer Finance Institute of the bank.

In such communities as Tacony, racial covenants started when the area changed from farmland to city, and set the stage for decades of de facto segregation long after they fell out of use.

“It was understood that there were areas where they couldn’t live,” said Hubert Barnes, senior pastor of Star of Hope Baptist Church, a century-old African American congregation in Tacony. “They knew where the invisible boundaries were.”

‘Restricted section’ becomes a selling point

Santucci’s research team conducted the first comprehensive search for Philadelphia deeds with racially restrictive language and found nearly 4,000 written from 1920 to 1932. Their language was far from subtle. The deeds “forbade the premises from being occupied or owned by persons, not of Caucasian descent,” Santucci’s report stated.

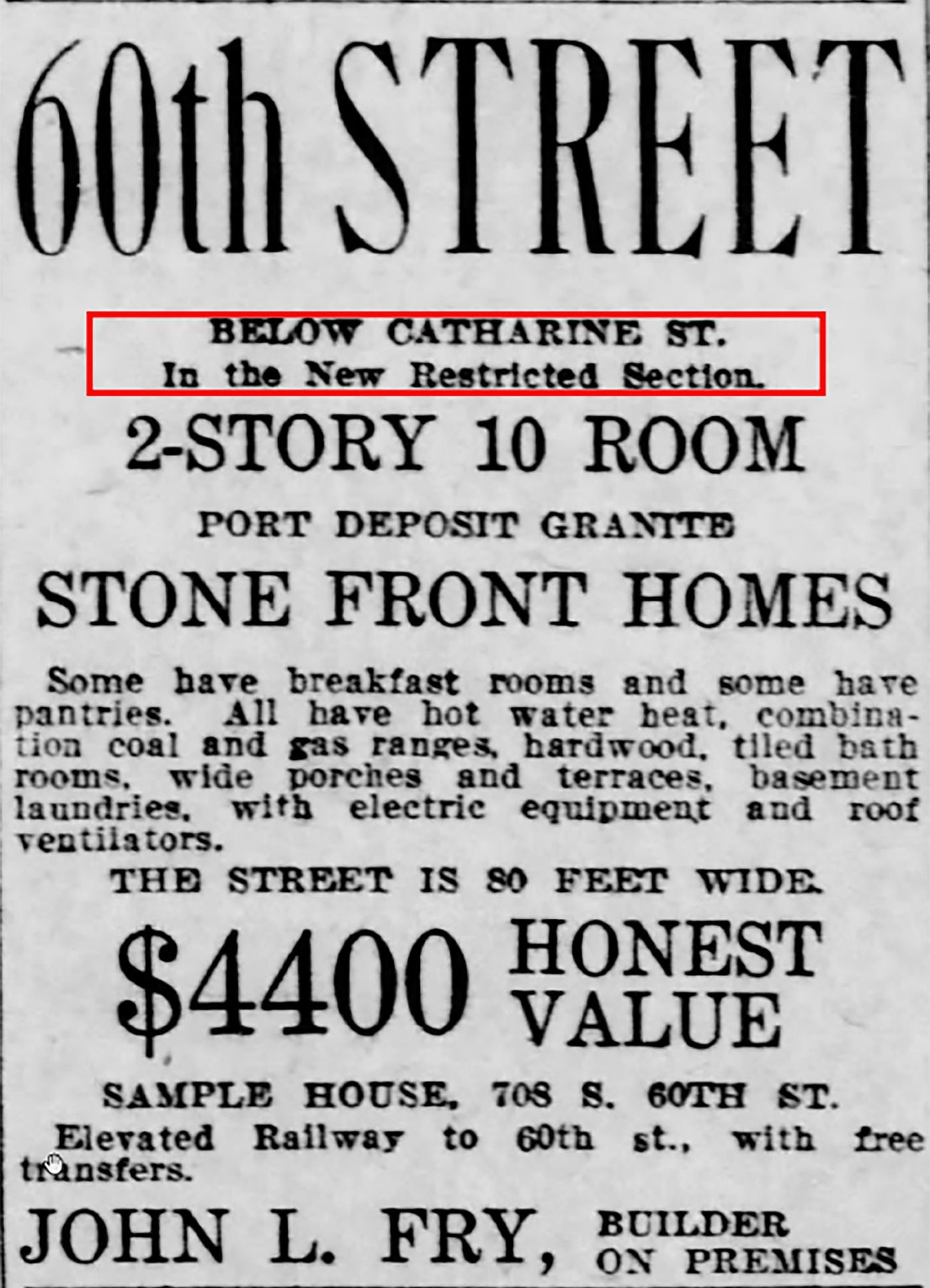

The restrictions were legal, boilerplate language included by developers and promoted by real estate agents. Being in a “restricted section” was a major selling point, as advertised in a 1911 Inquirer classified ad for real estate on 60th Street near Catharine Street. Some deeds encouraged property owners to maintain restrictions by force of arms, if necessary, according to a set of 44 deeds along West Penn Street from 1927.

The U.S. Supreme Court ruled that racial covenants were unenforceable in 1948, but such language was not made illegal until 1968.

The tools of segregation

White Philadelphians were inventive and comprehensive in building systems to keep neighborhoods segregated. In addition to racially restrictive deeds, racist zoning and violence were used to shape neighborhoods’ identities in ways that persist today.

“The most insidious legacy of all of this,” said Brent Cebul, an assistant professor of history at the University of Pennsylvania, “is how good neighborhoods get coded as white and bad neighborhoods get coded as black.”

Covenants were not unique to Philadelphia. Northern cities used them widely amid the Great Migration of 1.6 million African Americans. And they became more popular in the wake of Supreme Court decisions, the first in 1917, that zoning by race was unconstitutional.

Santucci’s report, released last month, looked at documents from 1920 because legal documents then began to be written exclusively with typewriters, making them more legible to modern scanning technology. He examined deeds until 1932, when the Great Depression significantly curtailed building in the city. He said a more comprehensive search would likely reveal more deeds with racial restrictions.

“If anything, I think we undercounted,” he said, saying that even typewritten documents from the era are difficult for a computer to read.

To continue reading, click here.