As the U.S. economy recovers from a decade of slow growth, more and more millennials – generally defined as people born between the early 1980s and about 2004 – are becoming a significant factor in the real estate market as they pay off student loans and become established in their professions.

“I work with many well-educated millennials who are finally working in the professions they trained so hard for and are settling down and getting married,” said Brooke Cashion, a broker with Allen Tate Realtors and president of the Winston-Salem Regional Association of Realtors. “Some are looking for more traditional properties, while others prefer modern construction, but they are all looking for a good real estate investment that will help them to grow their money.”

As many millennials begin to get on the feet financially after years of struggling with student debt and difficulty finding jobs in their chosen fields, she explains, they tend to be conservative in their financial planning and want to avoid taking on more debt than they can comfortably afford.

Cashion says that millennials are also looking for homes that reflect their lifestyles, allow them to live among likeminded neighbors and that offer the opportunity to be part of the communities where they live. “I find that millennials are very empathetic,” Cashion said. “They want to play a role in making their communities better places to live.”

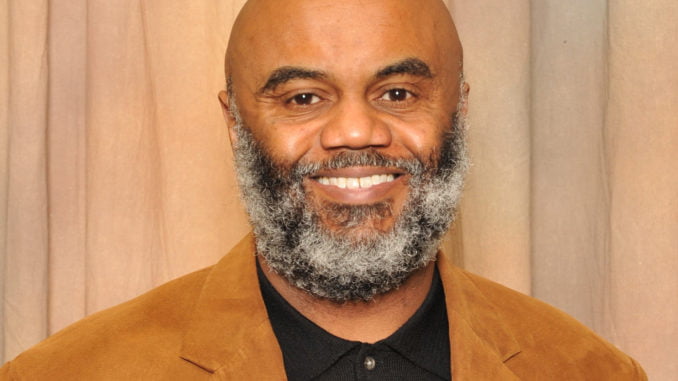

Brian A. Hudson, executive director and CEO of the Pennsylvania Housing Finance Agency, agrees with Cashion that community is very important to millennials. “They want to live close to where they work, especially when they can obtain a mortgage that is less than the rent they are paying.”

Hudson notes that the hot rental market in the last five years has caused more and more millennials to evaluate the tipping point between paying rent and paying a mortgage. “Even if they are not sure how long they will be in a certain community,” he notes, “many believe it makes sense to transition from renting to owning when rent payments equal or exceed mortgage payments.”

One of the obstacles facing millennials, as well as other homeowners, Cashion notes, is the lack of housing inventory. “I recently had a listing,” she says, “that had seven offers only a short time after it went on the market.” Cashion, who notes that millennials comprise 30 percent to 40 percent of her client base, said that this level of interest is not unusual for quality properties in the current real estate market.

“This lack of quality housing inventory,” Cashion says, “is not just a problem here in the Triad area, but in many communities across the country as well.”

An important requirement in reaching millennials, Hudson says, is making use of digital media.

“Running magazine and newspaper ads as we did for years does not work well with millennials. These days you have to be on Facebook, Snapchat, Instagram, Twitter and other social media because that’s what they rely on to get information.”